Bad Debts Double Entry

If the details specific bad debt recovery is known- dr the debtor s. Double entry for bad debts by.

Bad Debt Write Off Journal Entry Double Entry Bookkeeping

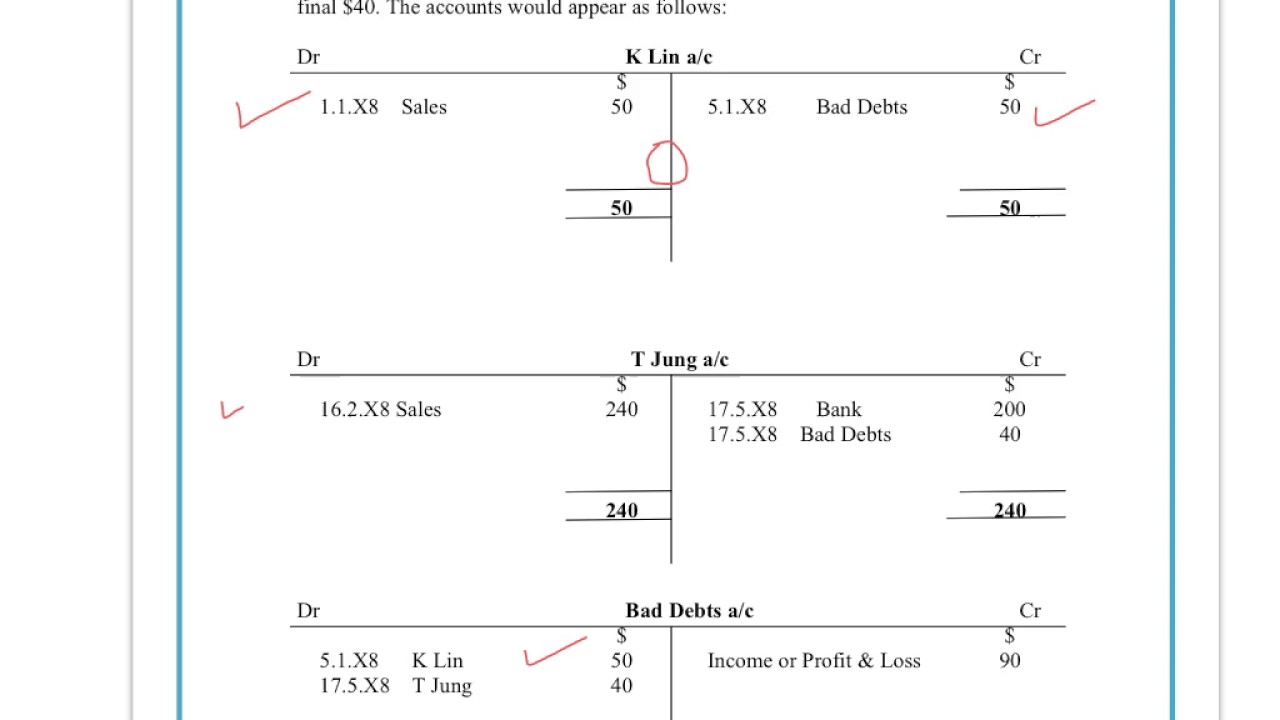

Debit Bad debts 500 PL Credit Receivables account 500 BS This entry will directly affect both the.

. From this amount the company can. For example company XYZ Ltd. Trade receivables 10 000.

The double entry would be. Decides to write off one of its customers Mr. Accounting entry to record the bad debt will be.

If however we had calculated that the provision should have been. After this double entry the remaining balance in accounts receivable will be 90000 100000 10000. Bad debts are uncollectible invoices that are written-off from the accounts.

A bad debt can be written off using either the direct write off method or the provision method. Although there are two ways to write off bad debt many business owners choose the allowance for doubtful accounts method. Debit bad debt provision expense PL 100.

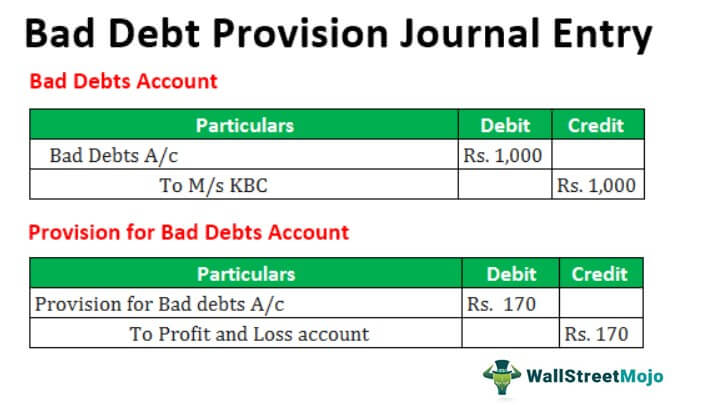

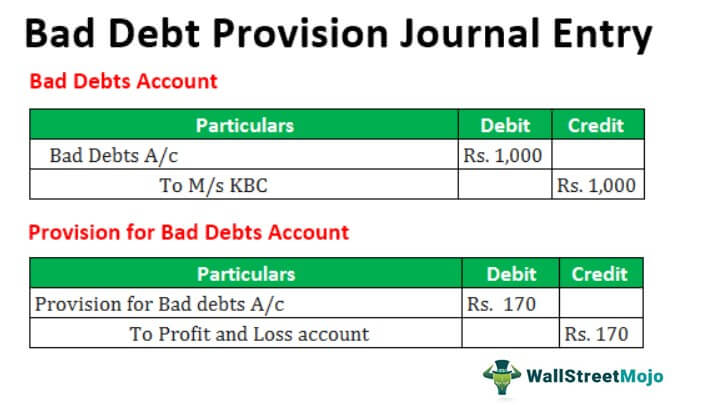

Now as provision for bad debts 2 on debtors is to made. Anonymous debit bad debts and credit debtors control. Bad Debt Expense.

Accounting entry required to write off a bad debt is as follows. August 21 2022. Debit Bad Debt Expense Credit Receivable.

The following accounting double entry will be passed in the books of the company. It means we have to make new. Credit Bad provision 100 BS.

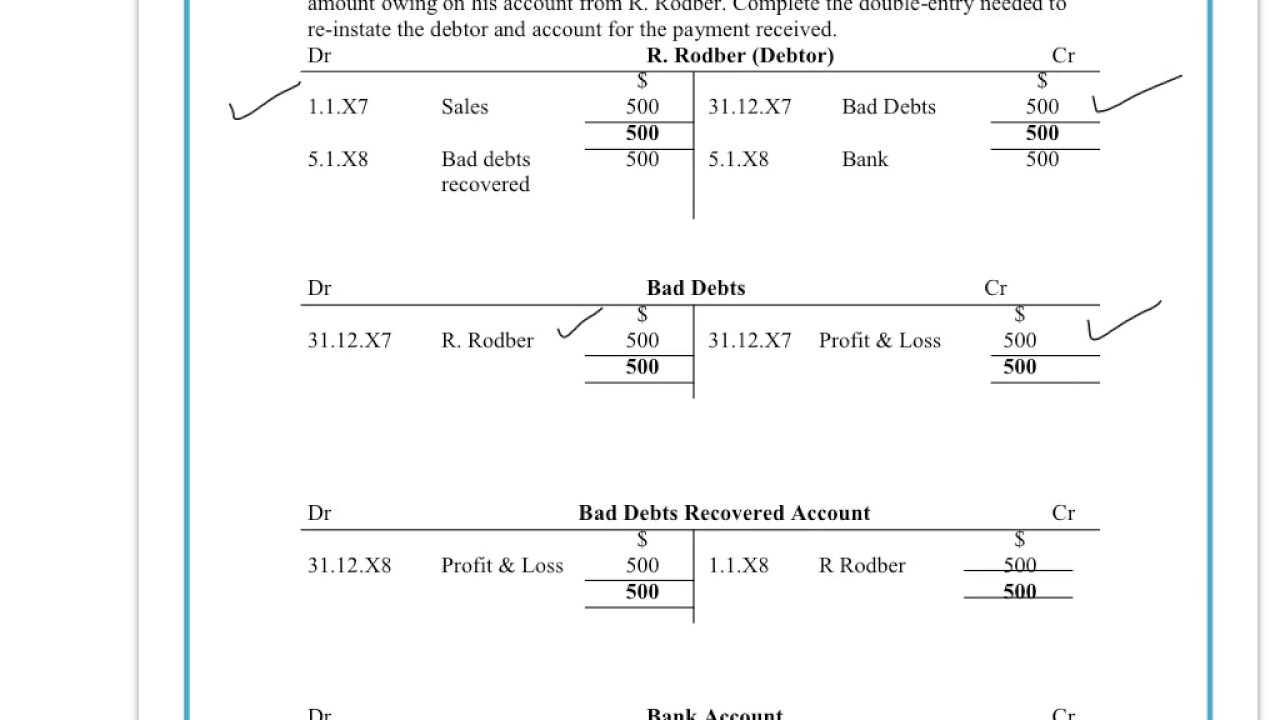

D by debiting the 800 into accounts receivable and crediting the same amount into the. In sight of accounting when a business has got an unpaid debt by the customers or clients we will use the following entries. When you create an.

In this case we can make the journal entry for this 50000. Solutions business what is the double entry required for recording the bad debt expense. Answer 1 of 4.

We use the allowance method to deal with bad debt so the net book value of their accounts on the balance sheet is already zero. Bad debts written off CR. When the goods are sold to customers on credit there can be a situation where a few of them fail to pay the amount due to them because of insolvency or any.

Here provision for bad debts for last year is given in trial balance is given. In this case the company ABC needs to make two journal entries for this bad debt recovery of Mr. The first approach tends to delay recognition of the bad debt.

The double entry will be recorded as follows. Accounts receivable 10000. Z as uncollectible with a balance of USD 350.

Any company that has a policy of selling goods on credit has to deal with the problem of bad debts.

Igcse Gcse Accounts Understand How To Enter Bad Debts Transactions Using The Double Entry System Youtube

Bad Debt Provision Meaning Examples Step By Step Journal Entries

Understand How To Enter Bad Debts Recovered Transactions Using The Double Entry System Youtube

No comments for "Bad Debts Double Entry"

Post a Comment